Republika Srpska will lose millions of marks that Investition-Development Bank RS has placed through loans because they won't be able to be collected from the value of assets of bankrupt companies due to court decisions that prohibit their sale. At the same time, the Republic Administration for Geodetic and Property Legal Affairs of RS is ordered to record the facts of a court dispute, which it previously flatly refused.

Written by: Andrijana Pisarević; Cover photo: Vanja Stokić

Clients who do not repay loans first sought to invalidate loan agreements through the court based on unlawful approvals at the time when they were signed by director Snežana Vujnić without authorization and mandate. Now they have found a legal way to stop the state and the bank from being satisfied through the sale of the assets they pledged as collateral for repayment, through a request to erase the mortgage as unlawful.

This is just one of the many problems that arose during Snežana Vujnić's four-year illegal leadership at the helm of IRB. She unlawfully signed tens of millions of marks worth of loans from 2016 to 2020 when she held this position, although she was neither appointed nor in an acting capacity.

One such case concerns the loan of the failed confectionery “Pingvin,” owned by Slavica Grebenar, who first sought the invalidation of the loan agreement through the court and then requested and received a court decision requiring the notation of the fact of a court dispute on her pledged real estate and the erasure of the unlawful mortgage. Initially, the Republic Administration for Geodetic and Property Legal Affairs rejected her request, but the District Court found that decision to be unlawful.

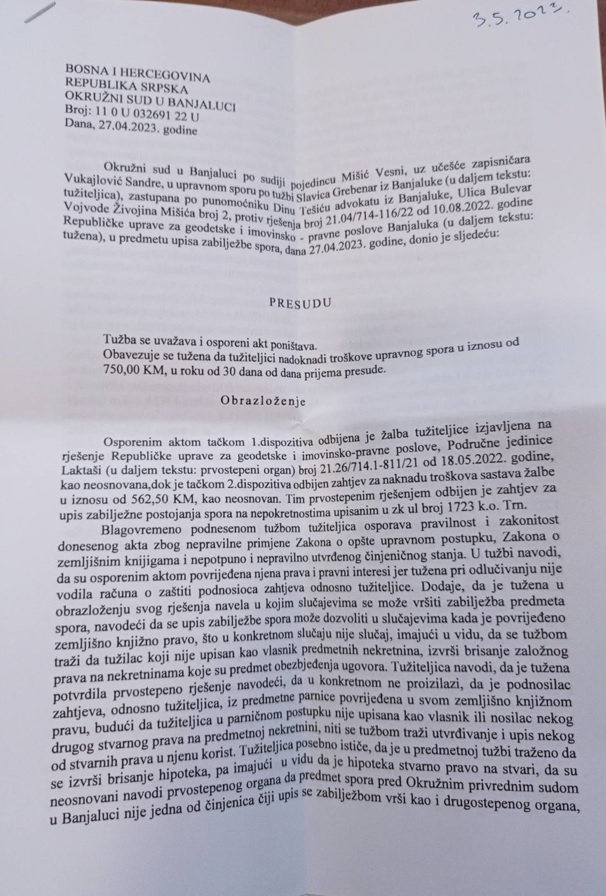

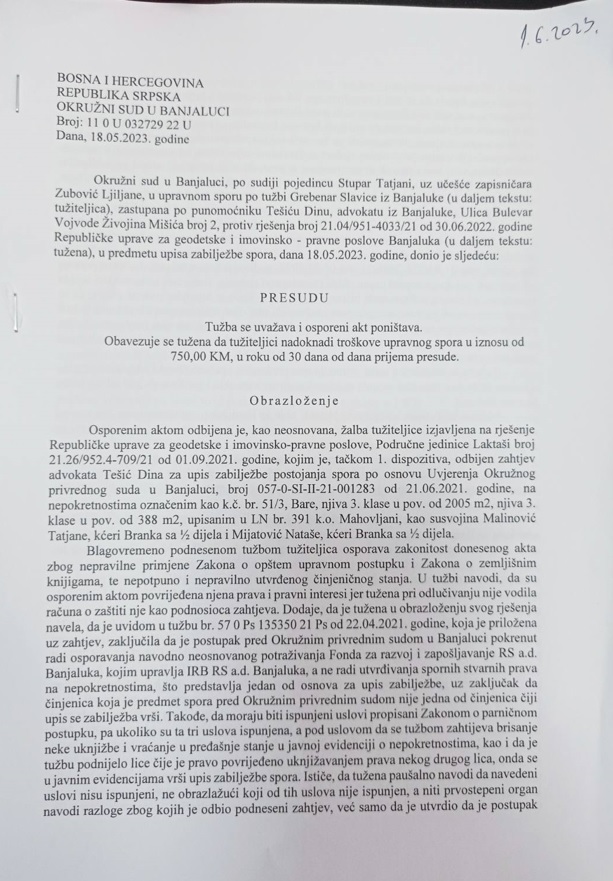

Thus, on April 27 and May 18 of this year, the District Court in Banja Luka accepted two lawsuits from Slavica Grebenar and ordered RUGIPP to reimburse her 750 KM for administrative proceedings costs and determine that her rights were violated because “the decision did not take into account her protection as the applicant.”

“The proceedings before the District Commercial Court were initiated to challenge the allegedly unfounded claims of the Development and Employment Fund managed by IRB, rather than to determine the disputed real property rights, which constitute one of the grounds for recording an annotation, with the conclusion that the fact in dispute is not one of those whose recording is performed,” as stated in the verdict of May 15.

Twenty days earlier, this court ruled in favour of Slavica Grebenar and stated that there had been an improper application of the General Administrative Procedure Act and the Land Registry Act and that the factual situation was incompletely and incorrectly determined.

“The recording of a dispute annotation can be allowed in cases where real property rights have been violated, which did not occur in this specific case, as the plaintiff, who is not registered as the owner of the real estate, seeks to erase the pledge right that is the subject of the contract security. The plaintiff specifically emphasizes that in the subject lawsuit, the request was made to erase mortgages, considering that this is a real right to property and that the first-instance authority's unsubstantiated claims that the subject matter of the dispute before the District Commercial Court in Banja Luka is not one of the facts whose recording is done by annotation,” as stated in the verdict.

Attorney Din Tešić, whose office specializes in banking and legal affairs, and who represents Slavica Grebenar, told eTrafika that the District Court in Banja Luka accepted the claims that the Republic Administration for Geodetic and Property Legal Affairs of RS unlawfully refused to record the fact of the dispute on the real estate owned by his client and annulled the disputed acts.

“From the beginning of the process, we faced constant pressure to prevent the recording of the dispute and to allow the bank to freely dispose of our client's real estate. These are the first final decisions in this legal matter, and we expect that the court will also accept and annul other claims of unlawful mortgage registrations by the Investment Development Bank of Republika Srpska and Nova Bank a.d. Banja Luka, as these are null and void legal transactions that cannot be validated over time. We have no doubt that this type of dispute will only have its final outcome before the Supreme Court of Republika Srpska or the European Court of Human Rights in Strasbourg,” Tešić said.

Vujinić was arrested in 2016, at the end of her term, which lasted from 2011, and the Prosecutor's Office of Bosnia and Herzegovina brought charges against her and 15 other individuals in March 2017 because they were alleged to have “acted as an organized group, causing damage of 122.5 million KM through financial crimes and various abuses, leading to the collapse of ‘Bobar Bank’.”

Immediately after her release from custody, the authorities of Republika Srpska reinstated her to her previous position, where she remained for more than four years (until the end of 2020), even though she was neither officially appointed nor in an acting capacity.

When eTrafika journalists requested her appointment resolution for a second term from the new management of IRB last year and demanded that a copy of the decision be provided with the response, they did not receive this document or precise dates of appointment and dismissal.

After 2016, Vujinić had no authority to represent the bank, and therefore, she had no right to sign any documents for this bank. Nevertheless, millions of marks in loans were placed through this bank, and all of them can now be subject to dispute if any of the clients invoke the legal basis of unlawful signing.

A significant portion of the money was placed in loans to companies close to the authorities, and many of them received funds even though they were on the verge of closure, such as “Pingvin,” which did not repay the loan. Their defence in the request for debt cancellation is based on the fact that the loan decision is void because it was signed by a person without authorization.

In Slavica Grebenar's case, one of the loans was approved during a period when Vujnićka did not have the authority to sign it, and her attorney claims that the contract is void due to the unlawfully calculated variable interest rate. He argues that through an analysis of loans from the Development and Employment Fund of Republika Srpska a.d. Banja Luka, managed by the Investment Development Bank of Republika Srpska, they have determined that it is a void legal transaction due to unlawful provisions related to the variable interest rate.

According to his words, certain banks, not only IRB RS, employ a calculation model for the annual interest rate of 360 days, applying unlawfully the French and German degressive interest calculation models contrary to the provisions of the Banking Agency of Republika Srpska, which, by its decision, designates the English 365/366 days as the only permissible interest calculation model.

This allowed for the unlawful appropriation of tens of thousands of marks annually by some banks during the approved moratorium by incorrectly calculating interest rates for clients affected by the economic crisis, applying unjustified and legally punitive interest rates, and not calculating the EURIBOR rate accurately. Instead, they round it up to the next positive quarterly figure, contrary to the contract and imperative norms. Besides these facts highlighted in disputes, the representative did not have the authority to represent IRB RS at the time of contract conclusion, which is why they previously asked the court to annul the contract and erase the mortgage on the real estate that was the subject of collateral. Now, they are in the process of realizing this.

In addition, the Supreme Court of Republika Srpska confirmed earlier the lower courts’ stance that post-mandate authorizations are of a technical nature and that actions are limited to tasks within the so-called technical mandate, meaning that acts cannot be issued that impose rights and obligations on other entities. In this specific case, acts issued after the mandate's expiration are unlawful, and the duration of the board member's (director's) mandate is determined by the number of years, months, or days. At the end of the last day of the mandated period, they cease to be a board member, and the actions they take cannot be considered as those of a board member.