In 2015, World Vision International, an evangelistic humanitarian organization, tried to relocate 13.3 million KM of donor funds intended to help the citizens of Bosnia and Herzegovina outside of BIH through a disputed loan agreement with MKO EKI. The implementation of the disputed loan agreement was initially stopped by the Banking Agency FBIH, however, due to this decision, Nizami Cataldo, head of the sector for monitoring the work of microcredit organizations, was given a notice of dismissal after “mobbing”, and the original ban on repaying the funds was lifted.

After the war, the development of the microcredit sector took place in Bosnia and Herzegovina thanks primarily to the state project “Lokalne inicijative LIP” (translation: “Local Initiatives LIP”) supported by the World Bank and other international organizations. The goal of establishing this sector was to increase employment, income and quality of life of socially vulnerable categories that are not available to the services of traditional financial institutions.

The very process of market creation was realized through the mentorship of international humanitarian organizations such as Mercy Corps, UMCOR, UNHCR, CHF International, CRS Catholic Relief Services and World Vision, whose work in BIH, in addition to numerous humanitarian projects, is closely related with the activities of the microcredit organization EKI from Sarajevo.

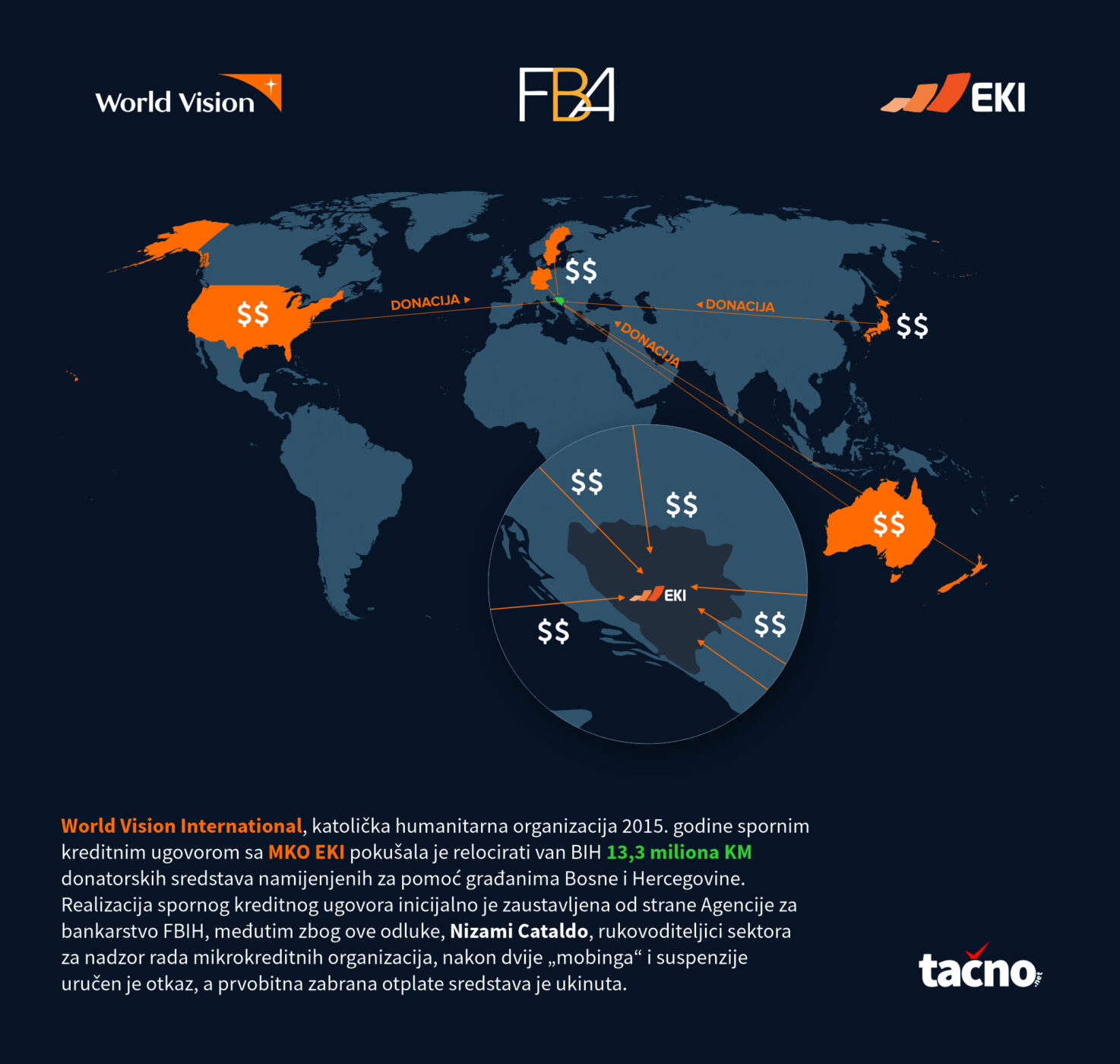

It was through World Vision, which today operates in over 100 countries, that initially distributed donor financial resources as well as equipment from organizations such as the World Bank, UMCORA, SIDA, USDA, UNHCCR, etc., which were intended for lending to socially vulnerable categories of the population in war-torn Bosnia and Herzegovina. In addition to these funds, World Vision also collected donations through its branches with the aim of creating credit capital for microcredit organizations in Bosnia and Herzegovina.

With the donated credit capital, the microcredit organization EKI was founded in 2001, which, after the establishment of the legal framework in FBIH, re-registered as a microcredit foundation in 2008, and later as a microcredit company.

The work of MKD EKI under the leadership of long-term director Sadina Bina was closely supervised by the Board of Directors, headed by financial expert Richard Reynolds, a key figure of World Vision in Bosnia and Herzegovina, for a long period of time.

MKD EKI office/photo: EKI

The regulation of the microcredit market in BIH began in 2006 through a series of legal frameworks that ultimately did not allow foreign organizations, such as World Vision, to acquire ownership shares in microcredit organizations.

This information is crucial for understanding the business relations between World Vision and MKD EKI, as well as the disputed credit arrangement in the amount of 13.3 million KM between these two organizations.

When donations become credit

The absence of legal possibilities for the share of ownership in MKO EKI as a percentage of the number of donations collected for the credit capital of this microcredit organization resulted in the search for legal possibilities to withdraw 13.3 million donor funds from this organization to the account of World Vision and sister organizations of the Vision Fund.

At the beginning of September 2015, the Banking Agency FBIH, the institution responsible for regulating the work of financial institutions, received a request from MKF EKI to issue an approval for the payment of 13.3 million KM under the credit arrangement between MKF EKI and World Vision and Vision Fund.

The Banking Agency FBIH, at that moment with Zlatko Barš in the position of director, after this request carried out a targeted control of MKF EKI’s operations, which established that this organization wants to repay the funds based on the loan agreement signed in 2001 and 2002 with the associated annexes that were signed subsequently.

Given that this loan agreement includes donations for permanent assets, funds from the realized surplus of income over expenses, and donations and grants from international donors, due to the well-founded suspicion that the loan agreement was fictitiously concluded with the aim of changing the origin of the funds, the Banking Agency issues a suspension order on payments of these funds until their origin and purpose are determined.

One year after the loan disbursement was suspended, at the end of 2017, in a new inspection by the FBIH Banking Agency, it was determined that MKF EKI did not obtain the necessary documentation that would indisputably prove that the funds covered by the loan agreement with World Vision/Vision Fund were loans, that is, that these funds are a donation with the aim of microcrediting in BIH

In March 2017, together with MKF EKI, the FBIH Banking Agency addressed directly international donors and development agencies with the question of whether the donated funds should remain in Bosnia and Herzegovina.

According to the official documents of this agency, which are in the possession of the Tačno.net portal, the World Bank explicitly stated that the purpose of approximately 336 thousand KM of their funds for the establishment and maintenance of a microcredit fund in BIH with the intention that these funds will remain in our country. In the response of the World Bank to the Banking Agency FBIH, it is stated that after the completion of the project, the funds should have been capitalized by MKF EKI.

Identical answers to the Banking Agency FBIH arrived from UMCOR for a donation of approximately 656 thousand KM as well as the organization “HELP-Hilfe zur Selbsthilfe” related to the amount of 50 thousand KM.

Banking Agency FBIH/photo: RVK

Also, in the later response of the Federal Ministry of Agriculture of the US Government, which donated 3.5 million KM through the USDA Food for Progress program, it is stated that these funds were donated for the activities of a specific project realized with World Vision and that they should remain in MKF EKI without the right to have these funds returned to World Vision.

In April 2017, MKF EKI submitted to the FBIH Banking Agency information related to the origin of the funds that are the subject of the credit arrangement with World Vision.

According to the official document of the MKF EKI, World Vision’s sister organizations in the world gave their approval for the return of funds through this loan: World Vision Germany, US, New Zealand, Australia, Japan as well as World Vision International. Other organizations, such as the Swedish agency SIDA, which donated a total of 6.4 million KM, pointed out that World Vision can transfer the funds to the Vision Fund, but only with the aim that these funds remain for the use of MKF EKI.

However, in August 2017, MKF EKI signed a settlement agreement with World Vision International and Vision Fund, which stipulated that instead of the original 13.3 million KM under the “EKI” credit arrangement, it would now pay 11.5 million KM, with the fact that as insurance of this transaction, the Banking Agency will cancel the repayment limit.

At that moment, the official position of the Banking Agency FBIH was that this arrangement would further raise doubts about the regularity-fictitiousness of the contract and that the realization of the payment would damage MKF EKI, while the multimillion-dollar amount would be taken out of Bosnia and Herzegovina.

Pressures on the Agency: Because of the hungry children of Africa

Esad Uzunić, the current director of MKF EKI, could not answer the questions of the Tačno.net portal about this credit arrangement, considering that it is a topic that has the character of a business secret and refers to open issues between MKF EKI and its founder World Vision International.

Unlike Uzunić, Adrian Marryman, Head of the Department of Development and Impact of Investments of World Vision International, to the questions of the portal tačno.net about the credit arrangement with MKF EKI, pointed out that the funds were channelled through loans so that they could later be withdrawn to help other vulnerable populations.

“Donations were originally given from pooled funds, not specifically to EKI, which was then a new microfinance institution. Later, Vision Fund channelled funds to EKI in the form of debt with 0 per cent interest. This approach did not bring any financial benefit to the Vision Fund, it only ensured that once the EKI was established, the donated funds could be redeployed to help vulnerable people in vulnerable regions, such as sub-Saharan Africa. This is our accepted practice to dispose of funds in a way that supports those who are most in need.”

However, it is not clear how the employees of World Vision and Vision Fund decided to distribute the donor funds, which according to the donors are exclusively intended for the citizens of BiH, to help the needy in other parts of the world.

With the changes in the position of the director of the Banking Agency FBIH, more precisely with the departure of Zlatko Barš and the positioning of Jasmin Mahmuzić, there is also a change in the attitude towards giving consent for the payment of this credit arrangement.

Nizama Cataldo, the former first person in the sector for supervising the work of microcredit organizations of the Banking Agency FBIH, emphasizes that in the period from the end of 2017 until her dismissal, pressure was exerted on the employees of this sector in order to change the initial order prohibiting the payment of the funds of the alleged credit.

“The agency already had evidence that the loan was fictitious, that is, that the funds from the alleged loan agreement were generated in excess of income over expenses, on which no tax was paid to the state, then donations for permanent assets and donations for the loan fund by certain donors of MKO EKI. However, Jasmin Mahmuzić insisted that the order be revoked. At that moment, pressure was put on me by the director personally through the degradation of working conditions and the appointment of new managers who gave verbal and written orders to change the solutions that would ultimately enable the payment of the said funds.”

Cataldo refuses to sign the proposal to lift the prohibitions, and instead of her, the decision to lift the payment ban is signed by the new director of the Sector for the Supervision of Operations of Non-Depository Financial Institutions, Alma Kozarić.

“Alma Kozarić subsequently put pressure on the employees to sign the adopted proposal, even though the entire department was against it and no one from the department wanted to bear criminal responsibility for the damage that would be caused by such an order. On the contrary, the employees of the MKO supervision department, together with the manager, insisted for a long period of time that a criminal report should be filed, and they prepared information about illegalities and sent them to the Agency’s protocol, contrary to several months of delays by the Agency and the acting legal support department and its managers Nudžejma Avdagić and Stanislava Radivojević.”

Shrouded in business secrecy: Banking Agency FBIH

After the criminal complaint was sent to the Sarajevo Canton Prosecutor’s Office, the “mobbing” against Nizam Cataldo intensified through a series of disciplinary reports and measures filed by Alma Kozarić. As a result of the pressure, Cataldo submits a complaint of mobbing. Not long after this application, she was suspended for disclosing business secrets to the Court.

“Upon receipt of the lawsuit, I was suspended for allegedly disclosing a business secret to the Court, even though the Agency itself sent Information to the KS Prosecutor’s Office about the findings of the aforementioned control. To make the absurdity even greater, neither the Management Board of the Agency ever adopted a rulebook on business secrecy in accordance with the new Statute issued after the adoption of the new Law on the Agency, nor does the Law on MKO speak anywhere about secret information as stated in the Law on Banks. The agency is exempted from the legal order of BiH and placed above state and federal laws and institutions and even the court, declaring publicly available information secret.

In the explanation for the dismissal of Nizami Cataldo, who essentially stopped the withdrawal of 13.3 million KM from Bosnia and Herzegovina, it was stated that she revealed the name of a microcredit organization in a lawsuit for mobbing.

“The absurdity is even greater because I was fired because of allegedly secret information that the Agency itself publicly publishes in its reports. MKO EKI publishes its audit reports. Foreign donors announce to whom they have given funds. These are publicly available data. However, the management of the Agency hides the abuse of position behind the confidentiality of data. A criminal offence cannot be hidden behind a secrecy clause.”

Portal Tačno.net addressed the Banking Agency FBIH with an inquiry related to the credit arrangement of MKF EKI and World Vision/Vision Fund, as well as questions about the pressure on the employees of this institution due to the suspension of the payment of 13.3 million KM.

This institution refused to answer the inquiry, justifying the move as a business secret, as well as their opinion that information related to donor funds intended for socially vulnerable categories of the BiH population is not in the public interest.

The Sarajevo Cantonal Prosecutor’s Office informed us that from June 2018 until today, the competent prosecutors are checking the allegations from the report.